Dear traders, I hope you are having a great Tuesday! As we start a new week, let’s take a look at the latest developments that are shaping the financial landscape.

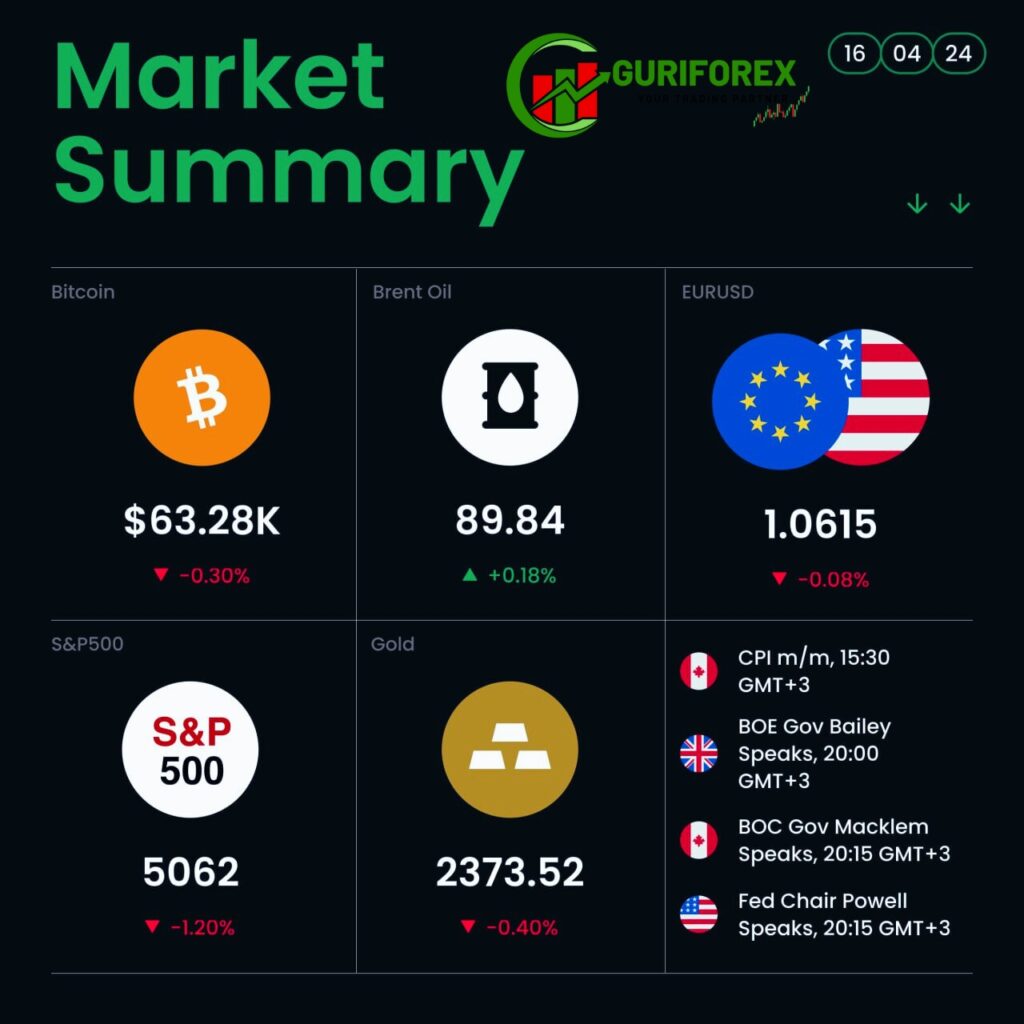

Cryptocurrency, Stock, Gold, and other markets news:

🌟 Citi’s bold prediction of gold soaring to $3000 per ounce within the next 6-8 months has sparked considerable attention, driven by anticipated rate cuts. Meanwhile, Goldman Sachs remains optimistic, forecasting a slightly lower yet still impressive $2700, buoyed by a robust bull market sentiment.

💬 However, amidst the excitement, UBS strategists caution about the looming specter of inflation. They warn that if inflation persists, the Federal Reserve might respond with aggressive rate hikes, potentially pushing rates up to 6.5%. Such a move could trigger significant market turbulence, warranting careful observation and strategy adjustments.

🇨🇳 Turning our attention to the East, China’s first-quarter GDP growth of 5.3% has exceeded expectations, demonstrating resilience in the face of mixed economic signals. While some indicators hint at potential future challenges, the overall performance underscores China’s continued economic prowess.

💰 In the world of cryptocurrencies, Hong Kong’s approval of its inaugural Bitcoin and Ethereum spot ETFs has stirred excitement, driving up prices for both assets. This milestone marks a significant step towards mainstream acceptance of digital currencies in traditional financial markets.

📉 However, the optimism in Asia was dampened by a sharp decline in stock markets, mirroring Wall Street’s recent downturn. Geopolitical tensions in the Middle East and concerns over long-term US interest rate hikes have cast a shadow over investor sentiment, highlighting the interconnectedness of global markets.

🇯🇵 Meanwhile, yen traders brace themselves for potential volatility as the currency flirts with the possibility of reaching 160 against the dollar. Despite efforts to curb its decline, ongoing weakness persists, raising the likelihood of government intervention to stabilize the currency’s trajectory.

🪙 Turning to tech, Microsoft invests $1.5 billion in AI firm G42, expanding its presence in the dynamic AI market. This strategic move highlights Microsoft’s forward-thinking approach. The alliance strengthens Microsoft’s standing and emphasizes AI’s pivotal role in shaping technological advancements. It’s a testament to Microsoft’s forward-looking strategy.

🚗 Tesla’s workforce reduction of over 10% mirrors struggles with declining sales and increasing electric vehicle market competition. It signifies adaptive measures. Despite its pioneering efforts, Tesla faces headwinds, as evidenced by the decline in its stock value.

Conclusion:

To successfully navigate through these dynamic market conditions, it is crucial to remain informed and adaptable. Let us approach the upcoming week with diligence, resilience, and a keen eye on the emerging opportunities and risks.

Wishing you successful trading!

Trading with Guriforex