🌤 Good day, traders! We’re here to keep you updated on global markets, including stocks, Tesla, and oil.

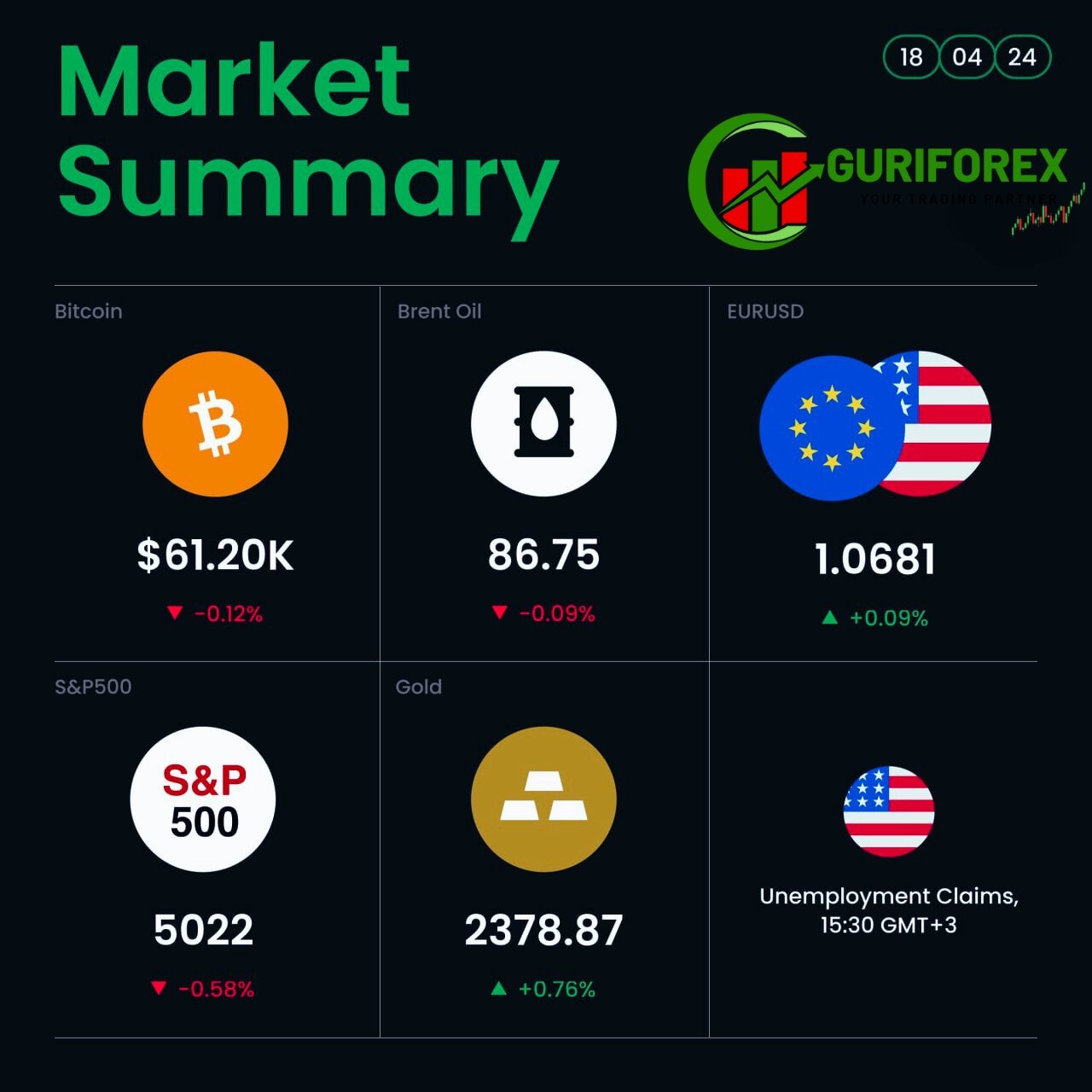

Today’s Oil, Stocks, Forex, and Gold markets news:

Let’s delve into the latest developments shaping the financial landscape:

🛢 Despite recent fluctuations, oil prices have managed to hold relatively steady. Factors contributing to this stability include a notable increase in US stockpiles and ongoing geopolitical tensions. Notably, Brent crude is trading below $88 per barrel following a notable 3% decline, signaling some volatility in the market.

☄️ In the United States, persistent inflation remains a significant concern. This inflationary pressure stems from the robust performance of the economy and labor market resilience. Consequently, the Federal Reserve has opted to maintain elevated borrowing costs. This decision is influenced by the continuous uptrend in housing, insurance, and commodity prices, reflecting the ongoing economic momentum.

⚡️ Global stock markets have experienced a surge in activity, accompanied by a rally in Asian currencies. This uptick in confidence follows a joint statement issued by the United States, Japan, and South Korea, addressing concerns over currency instability. Such coordinated efforts have bolstered investor sentiment and restored faith in the financial markets.

🚗 March saw a 2.8% decline in European car sales, which has particularly impacted the demand for electric vehicles (EVs). Countries such as Germany, Sweden, and Norway witnessed a notable decrease in EV registrations, primarily due to reduced subsidies and economic uncertainties.

🔥 Tesla, the renowned electric car manufacturer, is currently seeking shareholder approval for several strategic moves. These include reinstating Elon Musk’s controversial $56 billion compensation package, previously nullified by a Delaware court. Additionally, the company aims to relocate its incorporation to Texas, a decision with significant implications for its operations and regulatory landscape.

🧨 Rystad Energy has issued a warning regarding potential gas price surges in Asia. The consultancy firm suggests that if Iran were to close the vital Strait of Hormuz, gas prices in the region could skyrocket tenfold. Such a scenario would have profound implications for global energy markets and geopolitical dynamics.

🇦🇺 Meanwhile, the Australian dollar has demonstrated resilience in the face of economic challenges. Supported by positive employment data and a weakening US dollar, the Aussie has strengthened, despite rising unemployment rates and declining US Treasury yields.

💬 Nobel laureate economist Esther Duflo has proposed a novel solution to address climate change. Duflo advocates for the implementation of a global climate tax targeting billionaires, which could potentially generate $500 billion annually. Such funds could be utilized to support climate change mitigation efforts, particularly in developing nations.

👀 Looking ahead, The Economist predicts that interest rates in the United States are unlikely to see any significant reductions this year. This forecast poses challenges for financial markets and the broader global economy, as policymakers navigate the delicate balance between inflationary pressures and economic growth.

#Trade with Guriforex.