👋 Greetings, dear traders! Today, on Thursday, May 23, 2024, let’s swiftly navigate through the pivotal financial updates.

Today’s Market News includes U.S. stock, German GDP, Gold, GBPUSD, and XNGUSD:

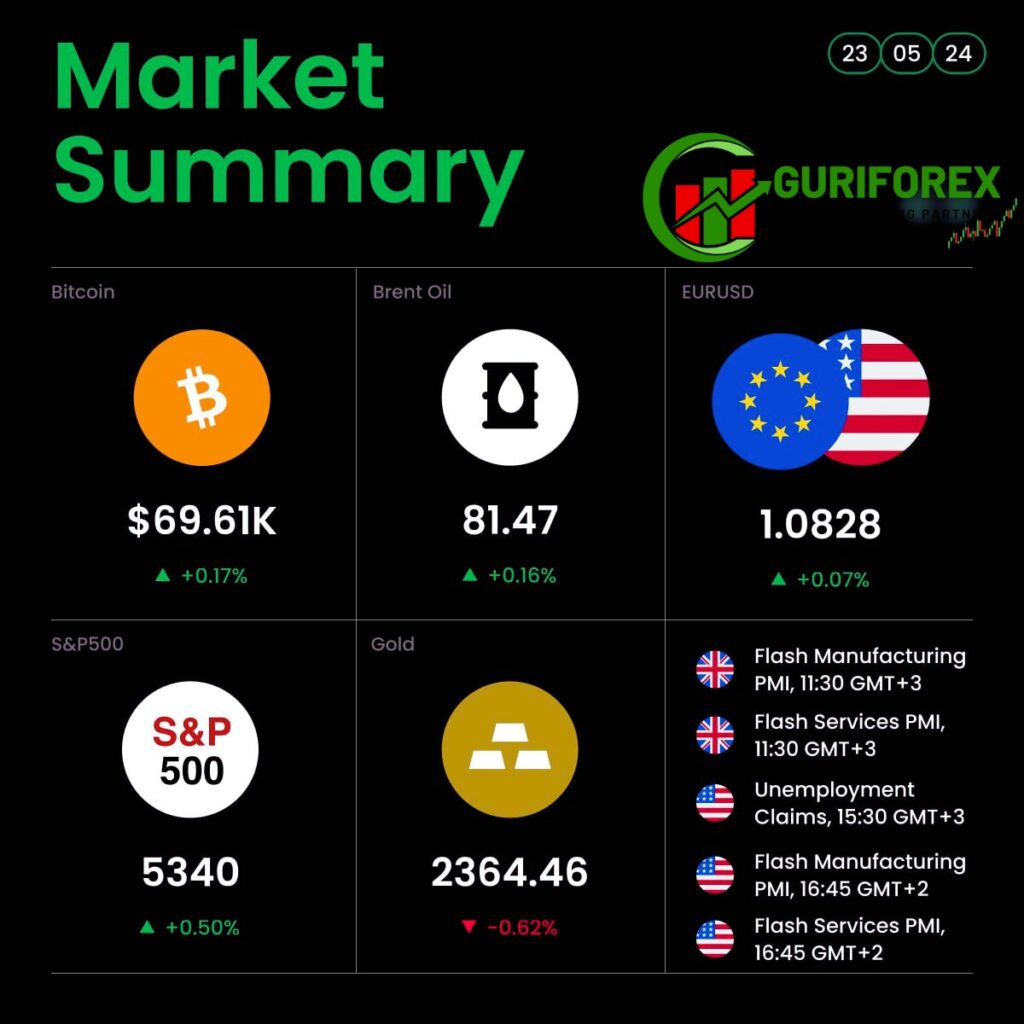

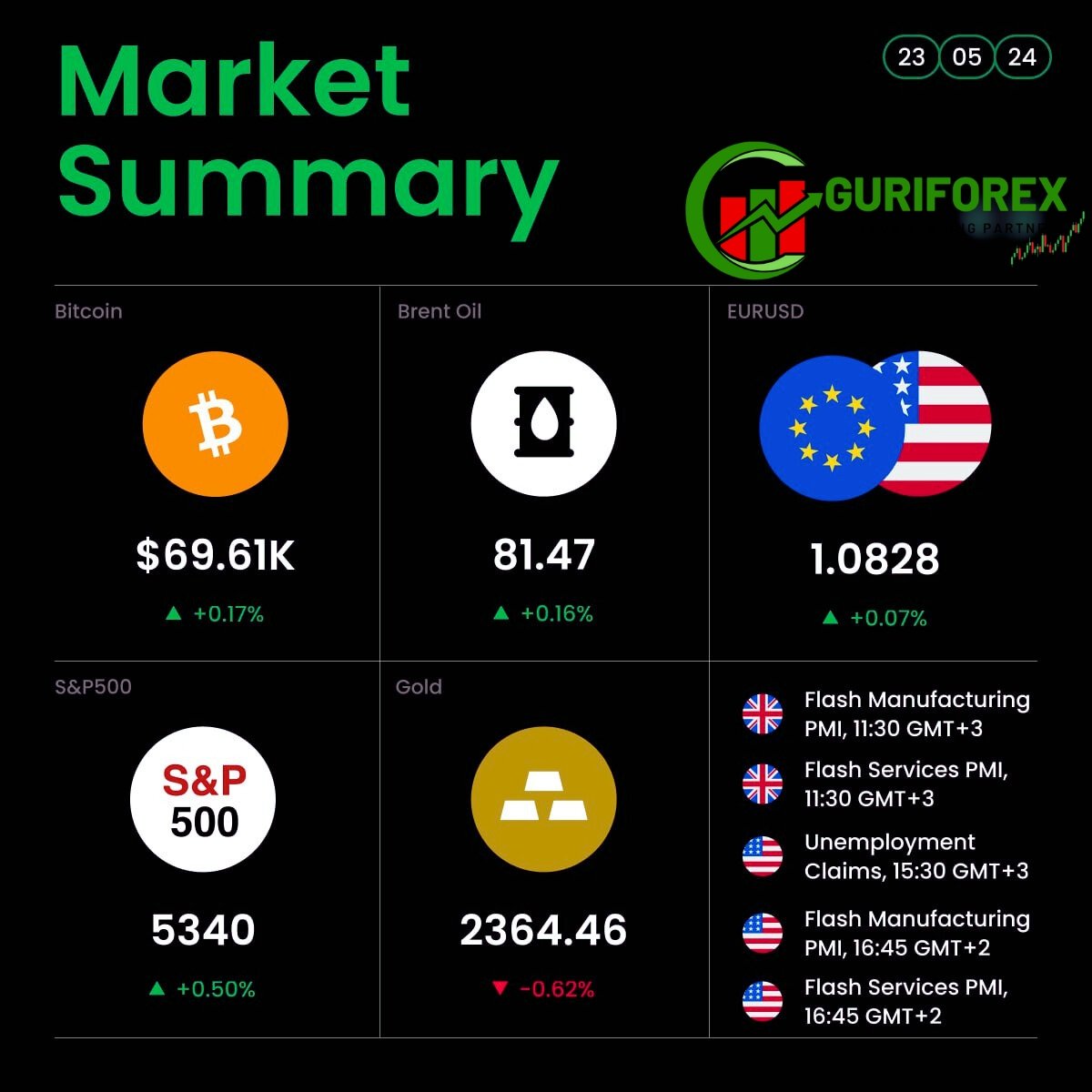

🥇 Although XAUUSD (Gold) is presently declining to 2364, Morgan anticipates a substantial increase to $2760, linking it to China’s escalating gold acquisitions. Consequently, Morgan forecasts that China will exert a significant influence on gold pricing.

🇩🇪 The German Central Bank anticipates robust GDP growth in Q2 2024, prompting analysts to revise their forecasts upward. The DE30 index consolidates at 18,709.

🇬🇧 The British pound surged amidst speculations that the Bank of England would follow the ECB‘s lead in rate cuts. GBPUSD is currently trading at 1.2730.

🌐 Bank of America notes record buybacks by S&P 500 firms. Goldman Sachs forecasts more increases, supporting U.S. stocks. The US500 climbed to 5341.

🤖 Following its earnings report, Nvidia revised its revenue forecast for Q2, hiked its dividend by 150%, and announced a 10-for-1 stock split. Nvidia shares are now valued at 948.55.

📉 JPMorgan CEO Jamie Dimon issues a cautionary note, warning of a potential “hard landing” for the U.S. economy and labeling stagflation as the “worst outcome.”

🥇 Although XAUUSD (Gold) is presently declining to 2364, Morgan anticipates a substantial increase to $2760, linking it to China’s escalating gold acquisitions. Consequently, Morgan forecasts that China will exert significant influence on gold pricing.

🔥 European gas prices could soon surpass Asian ones, with the price premium potentially shifting from Asia to Europe by June, according to FSEG. XNGUSD has surged to 3.02.

🇯🇵 Sustained growth in service prices in Japan may prompt the Bank of Japan to consider the next rate hike. The JP225 index has climbed to 39,071.