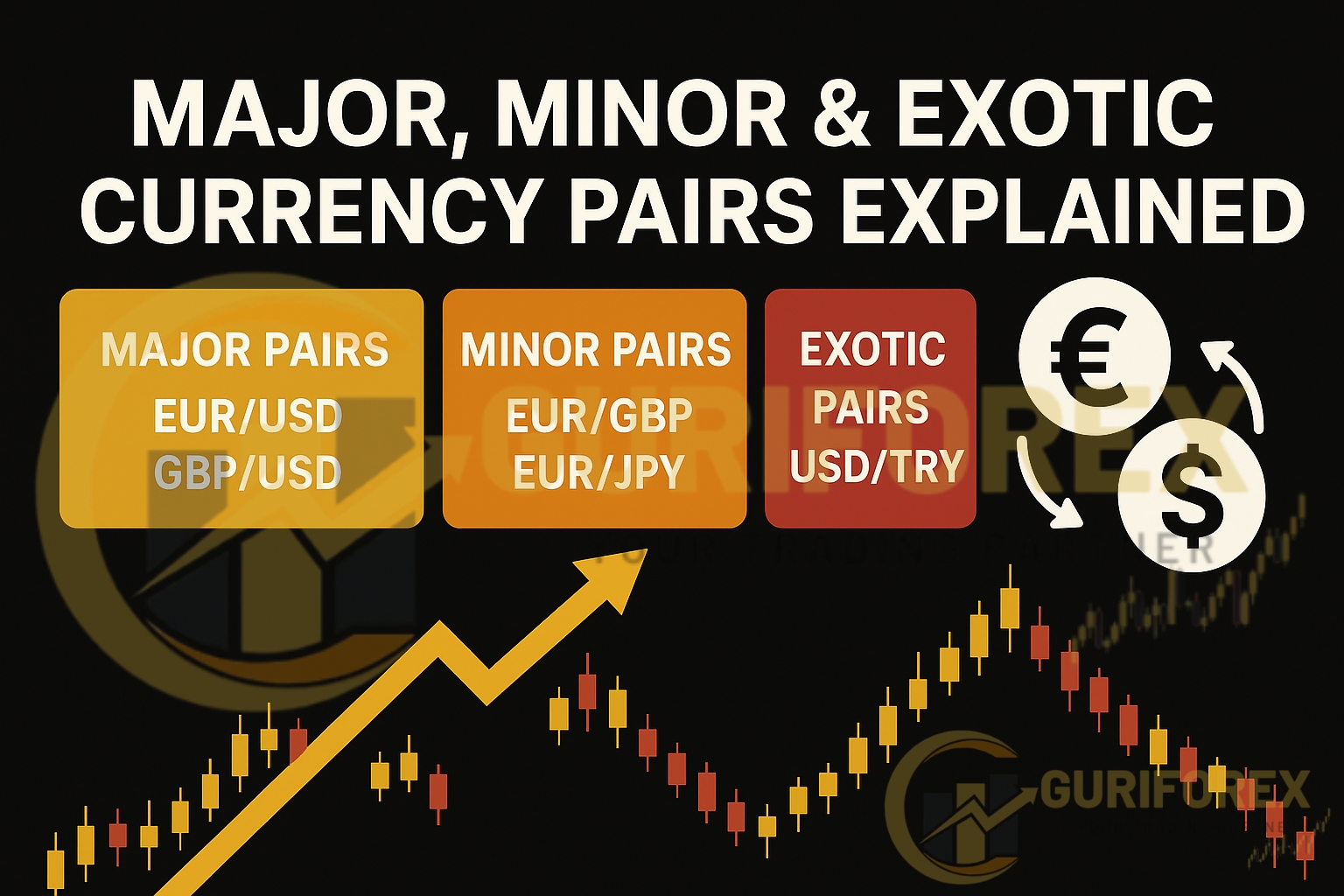

Major Minor & Exotic Currency Pairs Explained: A Complete Guide for Forex Traders

When stepping into the world of forex trading, one of the first things every trader learns about is major minor & exotic currency pairs. These pairs represent the exchange rate between two different currencies and form the backbone of the entire forex market. But not all pairs are the same—each type comes with its own characteristics that traders must understand to trade effectively.

Understanding these categories is crucial for traders to choose the right market instruments, manage risks effectively, and build successful trading strategies.

In this article, we’ll break down:

-

- What currency pairs are

-

- The difference between major minor and exotic pairs

-

- The most traded pairs in each category

-

- Pros and cons of trading each type

-

- FAQs about currency pairs

What Are Currency Pairs in Forex Trading?

In forex trading, currencies are always quoted in pairs, such as EUR/USD or GBP/JPY. These pairs are divided into three main categories known as major minor & exotic currency pairs, which help traders understand market liquidity and volatility.

The first currency in the pair is called the base currency, while the second is the quote (or counter) currency. For example, EUR/USD = 1.1200 means that 1 Euro (EUR) is worth 1.12 US Dollars (USD).

This pricing method makes it possible for traders to buy one currency while simultaneously selling another — the very foundation of trading major minor & exotic currency pairs in the forex market.

Major Currency Pairs

Major currency pairs are the most traded pairs in the forex market. They always include the US Dollar (USD), which is the world’s reserve currency and the most liquid in global trade.

List of Major Currency Pairs:

List of Major Currency Pairs:

-

- EUR/USD – Euro vs US Dollar

-

- GBP/USD – British Pound vs US Dollar

-

- USD/JPY – US Dollar vs Japanese Yen

-

- USD/CHF – US Dollar vs Swiss Franc

-

- AUD/USD – Australian Dollar vs US Dollar

-

- USD/CAD – US Dollar vs Canadian Dollar

-

- NZD/USD – New Zealand Dollar vs US Dollar

Why Trade Majors?

Why Trade Majors?

-

- High Liquidity → Easy to enter/exit trades

-

- Low Spreads → Cost-effective for scalpers and day traders

-

- Tons of Analysis → Plenty of technical and fundamental resources

-

- Stable Movements → Less prone to manipulation compared to exotic pairs

The EUR/USD alone accounts for nearly 30% of daily forex transactions, making it the most popular pair globally.

Minor Currency Pairs

Minor pairs, also known as cross-currency pairs, do not include the US Dollar. Instead, they consist of combinations of other major global currencies.

Examples of Minor Pairs:

Examples of Minor Pairs:

-

- EUR/GBP – Euro vs British Pound

-

- EUR/JPY – Euro vs Japanese Yen

-

- GBP/JPY – British Pound vs Japanese Yen

-

- AUD/JPY – Australian Dollar vs Japanese Yen

-

- EUR/AUD – Euro vs Australian Dollar

-

- GBP/CAD – British Pound vs Canadian Dollar

Why Trade Minors?

Why Trade Minors?

-

- Provide diversification outside USD-dominated pairs

-

- Often show strong trending moves

-

- Good opportunities for swing trading and cross-market analysis

Things to Watch Out:

Things to Watch Out:

-

- Wider spreads compared to majors

-

- Sometimes lower liquidity, depending on the pair and session

For example, GBP/JPY is known as the “Dragon” because of its high volatility, making it popular among advanced traders.

Exotic Currency Pairs

Exotic pairs combine one major currency (like USD, EUR, or GBP) with a currency from a smaller or emerging economy.

Examples of Exotic Pairs:

Examples of Exotic Pairs:

-

- USD/TRY – US Dollar vs Turkish Lira

-

- USD/SEK – US Dollar vs Swedish Krona

-

- USD/ZAR – US Dollar vs South African Rand

-

- EUR/TRY – Euro vs Turkish Lira

-

- USD/THB – US Dollar vs Thai Baht

-

- USD/HKD – US Dollar vs Hong Kong Dollar

Why Trade Exotics?

Why Trade Exotics?

-

- Offer huge volatility (large profit potential in a short time)

-

- Provide opportunities for traders who want to explore emerging markets

-

- Often react strongly to geopolitical events, interest rates, and local economic news

Risks of Trading Exotics:

Risks of Trading Exotics:

-

- Low Liquidity → Harder to enter and exit trades at desired prices

-

- Very High Spreads → Expensive for frequent trading

-

- Unpredictable Volatility → Price movements can be extreme and risky

Exotic pairs are usually recommended only for experienced traders who can manage large fluctuations.

Key Differences: Major vs Minor vs Exotic Pairs

Key Differences: Major vs Minor vs Exotic Pairs

| Feature | Major Pairs | Minor Pairs | Exotic Pairs |

|---|---|---|---|

| Includes USD | Always | No | Sometimes |

| Liquidity | Very High | Moderate | Low |

| Spreads | Lowest | Medium | Highest |

| Volatility | Moderate | Medium to High | Very High |

| Trader Type | All levels | Intermediate to advanced | Experienced only |

Which Currency Pairs Should You Trade?

The answer depends on your trading style, risk tolerance, and strategy:

Beginners should stick to major minor & exotic currency pairs, starting with the major ones like EUR/USD, GBP/USD, and USD/JPY. These pairs offer lower costs, higher liquidity, and easier technical analysis.

Intermediate traders can explore the minor pairs, such as EUR/GBP or GBP/JPY, which usually bring bigger price swings and more trading opportunities.

Advanced traders may cautiously test exotic pairs, but only with strict risk management in place.

⚠️ Always remember: when trading major minor & exotic currency pairs, liquidity and volatility are the key factors. Use stop-loss orders, control your leverage, and never overexpose your account—especially with exotic markets.

Final Thoughts

Understanding the difference between major minor, and exotic currency pairs is one of the first steps to becoming a successful forex trader.

-

- Majors: Best for beginners due to high liquidity and low cost.

-

- Minors: Great for diversification and advanced strategies.

-

- Exotics: High-risk, high-reward—suitable only for experienced traders.

By carefully choosing the right pairs based on your strategy, risk appetite, and trading goals, you can improve your chances of consistent success in the forex market.

4 thoughts on “Major, Minor & Exotic Currency Pairs Explained | Forex Guide”

Pingback: EMA vs SMA Forex Strategy: Master the Winning Edge in 2025

Pingback: When Does a Bearish Market Become Bullish in Forex?

Pingback: Does OANDA Allow HFT? Why Most Fast Trading Strategies Fail

Pingback: What Time Does the Market Open? Find the Best Hours to Trade Stocks and Forex